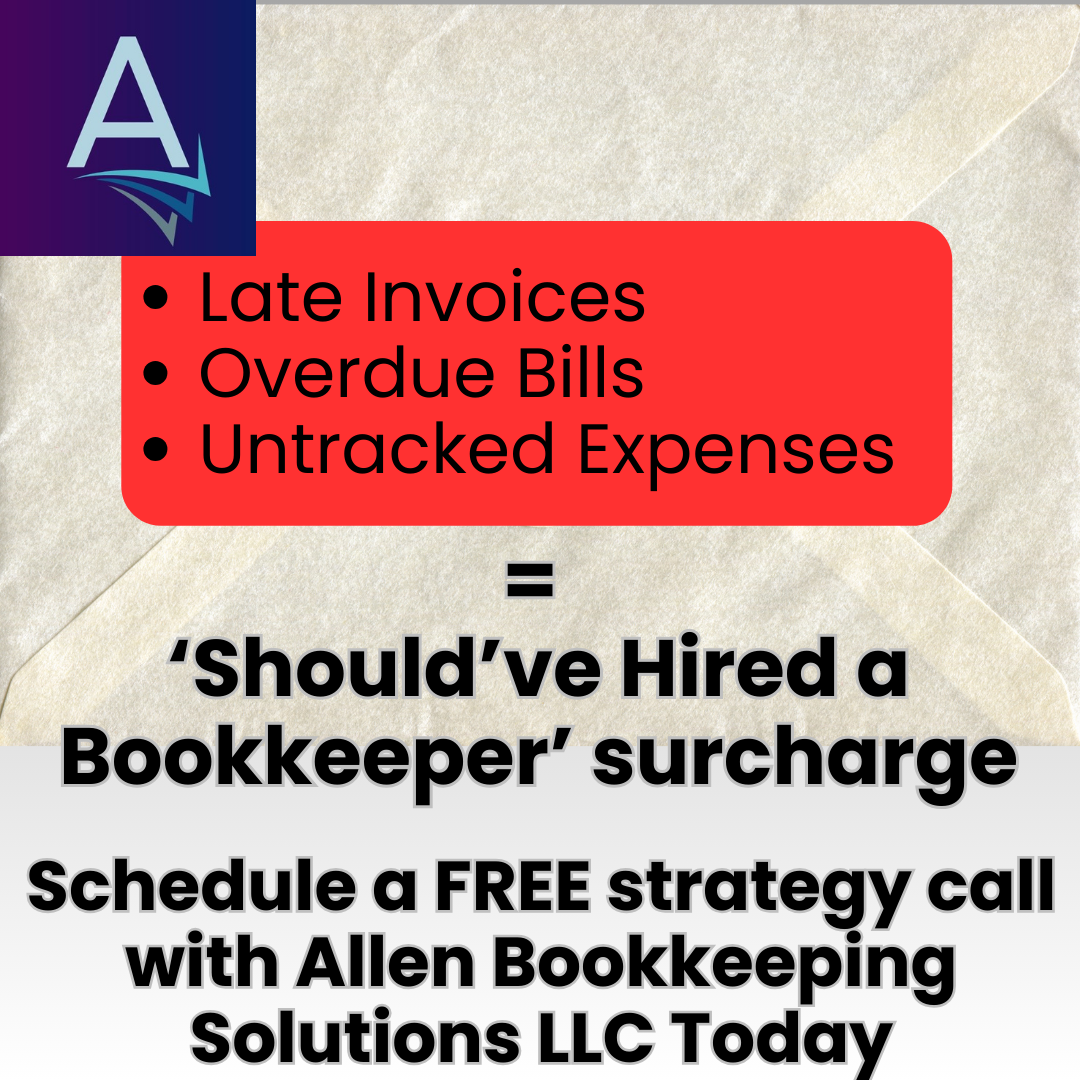

How do you know when you should have hired a bookkeeper?

When you’re paying late fees on bills. Your accounts receivables are getting longer and longer time horizons. You’re paying subscriptions and other fees that you believed you had cancelled or are no longer using. You’re panicking at the end of the month to put together depreciation tables, and researching methods to depreciate each asset you have, while scrambling for the records you kept from last year. You don’t even know if your P&L is accurately telling you if you’re making money or not.

Or you’d rather not do all this yourself… or at all for that matter.

For times like that, hire a bookkeeper.

You will save so much time compared to doing it yourself. That time saving will pay you a double dividend in peace of mind and more time to increase your profits. Even if it takes you 10 hours a month to do your books (the last business owner I talked with took 14 hours a month!), how much extra income can you make dropping that down to 2 hours a month?

It is a no brainer, and is the first step most smart business owners make because it gives them more accurate reporting for decision making, and gives them a significant amount of their time back. Plus, hiring a freelance bookkeeper is much more cost effective than hiring someone in-house, who likely would have to wear many hats to give them enough stuff to do!

You should have hired a bookkeeper if you want your time back and the peace of mind that your books are better organized than you could have done yourself.

Schedule a free strategy call with me to talk about your business goals and how I as your bookkeeper can save you time and money while getting you more accurate reporting.